Coal Projects Group, LLC

COAL NEWS!

Request to be added to our mailing list and find out

why the Metallurgical Coal Market is so HOT!

Click on any blue or red underlined title below to jump to the article

The demand for met coal will be primarily driven by the demand from Asian countries, like China, Japan and Korea. In Latin America, Brazil is expected to create demand for met coal due to its ongoing development work for the approaching World Cup and Olympics. (added 8/1/13 from recent news articles exerpts)

-

Steel Industry Outlook as of July 2013 - July 03, 2013

-

Asia Accounts for 25% of US Coal Exports - June 20, 2013

-

The US EIA Reports Record US Coal Exports - June 20, 2013

-

Is Coal Still Worth A Look? - June 15, 2013

-

Export markets for both metallurgical and thermal coal still have promise."

-

U.S. Coal Exports Drop in April - June 14, 2013

-

India's Coking Coal Imports Seen Rising in 2013-2014 - May 22, 2013

-

Mechel Sees Improved Coal Market - May 13, 2013

-

Peabody Energy updates on global coal markets and position - Apr 19, 2013

-

India's metallurgical coal imports are likely to grow by 8.7% as additions to its steel-making capacity lift demand

-

Profiting from the Asian Coal Race - Apr 15, 2013

-

Coal Industry Stock Outlook - Apr 02, 2013, In Feb 2013 global steel production increased 1.2% year over year. Global steel demand in 2013 is expected to improve marginally from 2012 levels, which will benefit the coal industry. Read full article

-

Metallurgical Coal Sales up 9%-Walter Energy Q1 Report - Mar 11, 2013

-

Evidence World Demand Is Present for Metallurgical Coal - Mar 07, 2013

-

Metallurgical Coal To Bounce Back In 2013 - Jan 24, 2013, Projected spikes in metallurgical coal demand in China & India/a major driver for growth this year.

-

Chinese Market Reforms Impact Coal Market - Jan 04, 2013

-

Chinese Growth Welcome News For Coal Producers - Dec 07, 2012, "producers could see prices rise alongside demand as early as mid-2013".

-

ARCH CEO Bullish on Demand - Nov 30, 2012

-

Australia's Coal Costs 'Are America's Gain' - Nov 28, 2012

-

India's Growth Leads Coal Demand Abroad - Nov 26, 2012

-

Expert predicts price of coal to rise with strong demand - Nov 22, 2012

-

Demand for Met Coal in China Expected to Rise as ..... - Oct. 16, 2012

-

Analyst sees uptick in metallurgical coal prices - Oct. 11, 2012

-

US export executive sees Q2 2013 met coal recovery - Sept. 20, 2012

-

Why Coal Stocks Were On Fire Today!-Sept. 7, 2012

-

U.S. miner Consol sees steelmaking coal prices up-2013-Sept. 6, 2012

- Why Everyone Should Be Investing in Met Coal right NOW!

- LONG-TERM SUPPLY AND DEMAND FOR METALLURGICAL COAL

- JAPAN CRISIS!

- JANUARY 2011 NEWS QUOTES

- WHY MET COAL IS HOT - The Unexpected Crisis in Coal

- CATERPILLAR TO BUY BUCYRUS FOR $7.6 BILLION - 11/15/10

- Metallurgical Coal Update - 9/21/10

- An Overview Of Future Demand And Prices Of Coking Coal

- COKING COAL

- U.S. ENERGY ADMINISTRATION REPORTS LINK

- PREPARE NOW FOR THE MET COAL SURGE

Evidence the world demand is present for metallurgical coal, analysts with Goldman Sachs last month [Feb. 2013] also forecast a pickup in U.S. demand for power-plant coal in 2013. Prices for U.S. natural gas are up 38% from a year ago, likely pointing to an increase in utilities' appetite for coal, the analysts wrote. While the global steel industry is running slower than its pre-recession peak in much of the world, record Chinese steel production has been enough to prop up coal demand and prices. Steel-making coal prices at Australia's main export hub, a benchmark for the industry, are up 21% from their lows late last year, to $154 a ton. Chinese imports doubled in January from year-earlier levels, to 6.48 million tons. Source: FN Media Group, LLC

One of our investors sent us this article from an online research group.

We encourage you to review and consider subscribing to Casey Reasearch

The World's Supply and Demand for Coal

By the Casey Research Energy Team - 2011

By the Casey Research Energy Team - 2011

Coal prices are surging ahead even as most other commodities pull back, spurred on by expectations that metallurgical and thermal coal production will again fail to meet rising global demand this year. The result? Record profits for major coal producers like Xstrata, a surge in acquisitions from coal-hungry India, Chinese electricity shortages, and a raging carbon tax debate in Australia amid record investments in that country's coal-heavy mining sector.

The price spikes in the second half of 2008, which were completely unsustainable and disappeared rapidly in the recession, distort the picture. So instead, imagine the above graph without those peaks. What you get is an almost sustained ascent in the spot prices of thermal and metallurgical coal over the last four years. Metallurgical coal, which is used to make steel and is also known as coking coal, has almost doubled in price, climbing from just above US$80 per ton in mid-2007 to more than US$160 per ton today. Thermal coal, which is burned to generate electricity, has risen from the US$45 per ton range to almost US$80 per ton.

There are a couple of countries that really take notice when coal prices start to rock. Australia is the world's biggest coal exporter and relies on thermal coal for 80% of its electricity. China mines more coal than any other country in the world but still imports more to support its power and steel-making needs - the country mines and burns more than three billion tons of the black stuff annually. And India - where the economy is growing at 8% annually - is facing multimillion ton coal shortages even as it works to halve a 14% peak power deficit within two years.

Let's start with Australia, a country embroiled in a debate over newly introduced carbon taxes. Those taxes are set to come online in mid-2012, ahead of a cap-and-trade system that could begin as early as 2015. Proponents say the tax is necessary to force a coal-reliant country to move toward cleaner energies. However, the tax has drawn widespread criticism from the nation's huge coal industry. Australia supplies 19% of the world's thermal coal and 59% of its coking coal; these industries are worth A$18 million and A$40 million, respectively (2009 numbers). With coal prices expected to keep rising for the next few years at least, Australian coal miners had big expansion plans. Instead, if the carbon tax goes ahead, the industry says it will have to close mines, meaning major tax and job losses for the nation. Opponents of the tax also say it will make Australia's own energy more expensive and less reliable.

Another argument against the tax is that reducing Australia's coal output could in fact increase global carbon emissions, because power stations in China and India would simply use dirtier coal to fill the gap. Australia's thermal coal is perhaps the best in the world, with high energy content and few impurities. Thermal coal from Indonesia has only 70% of the energy value of Australian thermal coal, which means that much more coal would have to be mined, processed, and shipped.

In the context of this very current, heated debate - the Australian coalition government is set to meet this weekend to hammer out the details of the tax - a new report from the Australian Bureau of Agricultural and Resource Economics and Sciences shows that planned investments in the country's mining sector have soared to a record A$173.5 billion. The figure represents development plans for 94 projects, including 35 mineral projects, 35 energy projects, 20 infrastructure projects, and four processing projects. The Bureau estimates A$55.5 billion in mining-industry expenditures in the current year alone.

A fair chunk of these investments will come from coal companies, who have money to spend because the current coal prices are providing record profits. Xstrata, the world's largest exporter of thermal coal, is expected to report an 83% gain in net income this year, according to a Bloomberg compilation of analysts' expectations. Another good example comes from Arch Coal (N.ACI), which recently tendered a $3.4 billion offer for International Coal Group (N.ICO) aimed at creating Australia's second largest metallurgical coal producer.

China is another major coal producer, but there the issue is coal shortages. The country's economy is steaming ahead at a 10% growth rate, and that kind of development requires a lot of steel. This year alone China is facing a shortfall of 56 million tonnes of metallurgical coal - the country is expected to produce 513 million tonnes, but consumption will reach 569 million tonnes. The Asian giant imported 47 million tonnes in 2010, helped by a 278% increase in imports from Mongolia. And even though domestic coking coal production is expected to increase by 80 million tonnes per year by 2015, China's latest estimates predict a 100-million tonne annual shortfall in coking coal by 2015.

It is not just coking coal that China needs. Shortfalls in thermal coal supplies are main culprit in an expected 30-million kW summer power deficit. And the problem is exacerbated by the fact that the country's electricity pricing system has not kept up with coal price increases. Plants sell electricity to the State Grid Corp. of China (SGCC) at a set price, and SGCC then resells to consumers. But the set price has not kept pace with coal prices. As such, coal-fired generators lose money for every ton of coal they burn, which is not exactly an incentive to produce more power. Over the past three years, China's top five state-owned power generating plants have lost some 60 billion yuan, while SGCC posted a 40-billion yuan profit last year alone.

China is expecting to face its worst power shortage in years this summer. Widespread droughts, which have decimated the country's hydropower capacities, are not helping. As many as 20 provinces and territories have already been put on power rationing, including the country's industrial heartland. Some 44 major industries in Zhejiang (a manufacturing hub near Shanghai) have been told to limit consumption or face prohibitive tariffs. The story is much the same in Guangdong, south China's manufacturing hub. And producing more coal is not an option - the government has acknowledged that China is near its peak coal production capacity.

To continue on a familiar theme, India is also facing an acute coal shortage. In April, for example, the nation imported 32 million tons of thermal coal against a total requirement of 36.9 million tons. At the end of March, 26 of India's thermal power stations reported having only critical stocks of coal, including ten stations with fewer than four days' worth of fuel. On Monday the prime minister convened an emergency meeting to discuss the coal shortages, which are expected to total 112 million tons over the next 12 months.

India has been working to address the coal void for some time now. Indian firms have been scouring the globe for coal assets and the effort has secured several major deals: Indian conglomerate Adani is set to buy the 25-million-tonne-per-year coal export terminal as Abbot Point in Queensland, only a year after buying the Galilee coal project in Australia for $2.7 billion; Indian trader Knowledge Infrastructure signed a joint venture deal with Indonesian miner PT OSO International to develop thermal coal mines in Kalimantan; and three Indian firms are among those shortlisted to buy Australian coal explorer Bandanna Energy, a deal expected to top $1 billion.

Coal India, which produces 80% of the country's coal, is not going to be left out of the shopping spree. A few months ago the company set aside $1.2 billion for overseas buys, specifically in Australia, Indonesia, and the U.S. And it has the money - net income for the first quarter totaled $931 million and full-year profits were up 13%. Shares in Coal India started trading Nov. 4 after the government raised $3.2 billion by selling a 10% stake, in the country's largest public offering to date.

The story could go on, discussing other coal-needy countries like Japan, South Korea, Germany, and so on, but perhaps the point has been made. Global production is maxed out with respect to existing infrastructure, so increases from here can only occur as quickly as new mines, rail lines, and ports can be built. Coal prices have been climbing steadily, based on real supply constraints, and most industry watchers agree that they will hold their ground or continue to climb for the next few years.

Those countries with coal should count their blessings.

If you are an investor you may want to consider a subscription to Casey Research for current coal news and what they see happening in the market.

Editors Note: U.S. investors are seriously missing out. Foreign investors are making the deals, finding Met Coal properties and profiting right underneath your eyes. This is a wake up call!

General Coal Market:

According to the World Coal Association, at current production levels there is enough coal to last the world 119 years. The key part of that statement is “at current production levels.” That means we will have 119 years of coal production if, and only if, we maintain a zero growth rate in annual coal production.

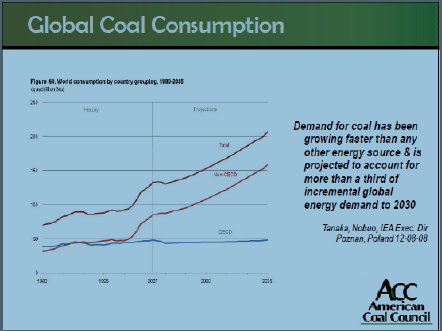

The Energy Information Administration (EIA) forecasts worldwide demand for coal to rise to 175.2 quadrillion Btu’s in 2025 from an estimated use of 140.6 quadrillion Btu’s in 2010, an increase of 24.6%. Meanwhile, the mining industry has barely been able to keep up with the increase in global demand in recent years. In 1990, total world demand was 89.2 quadrillion Btu’s, while total world production was 91 quadrillion Btu’s, creating a surplus of 1.8 quadrillion Btu’s, or just over 2%. By 2006, the last year for which complete production figures are available, global demand had climbed to 127.5 quadrillion Btu’s, while global output had risen to just 128.49 quadrillion Btu’s – a surplus of just .99 quadrillion Btu’s, or .77%.

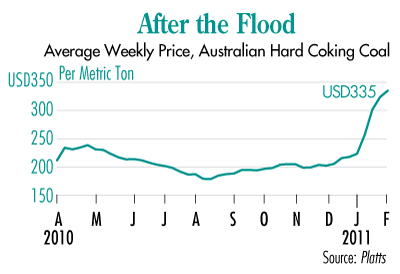

Considering the increasing worldwide restrictions on mining operations, the shrinking likelihood of new coal discoveries, and the fact that coal grades are declining in their energy content, it’s hard to see where another 35 quadrillion Btu’s worth of coal is going to come from without the enormous investment and buildup in mining activity. There’s no doubt that going forward the market will become increasingly tighter. Therefore sudden disruptions in the supply chain, such as what recently happened due to the flooding in Australia, will cause major price movements upward.

What is also very important to consider is what the EROEI ratio is. EROEI stands for Energy Returned on Energy Invested. The reason as to why consumption and production have been described in terms of quadrillion Btu’s rather than the much simpler and more straightforward tonnage, is because there are significant differences in the quality of coal.

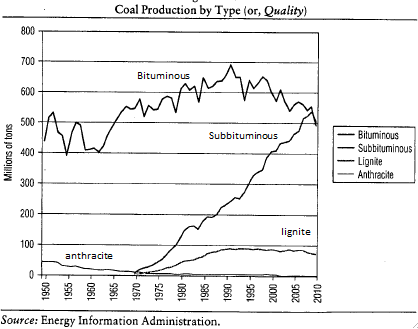

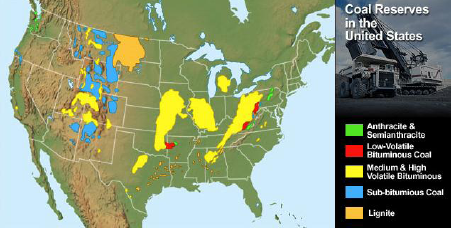

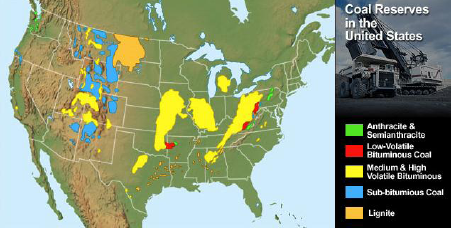

Essentially, coal comes in several different grades. The most desirable grade is shiny, hard, black anthracite coal. It yields the most heat when burned, has low moisture content, and is highly valued in the steel-making industry. After anthracite comes bituminous coal, offering slightly less energy per pound of weight, and then subbituminous, and then finally something called lignite (aka “brown coal”), which is low energy, high-moisture stuff that really has no use besides burning.

The following graph shows the United States’ history with mining coal, separated out by the different grades:

Focusing on the production of anthracite, a steadily declining line is evident. This indicates that less and less of the most desirable form of coal is being mined. The reason more anthracite isn’t being mined is because it’s not possible. The United States’ entire bank account of anthracite, formed over hundreds of millions of years, has been largely exhausted in a span of about 100 years. When it’s gone, it’s gone.

After anthracite, mining efforts focused on the next-best stuff—bituminous coal—and we find that a peak in the production of bituminous coal was hit in 1990. Was this because coal companies lost interest in the next-best grade of coal? Hardly. It simply means the US has started to run out of bituminous coal as well. Naturally, mining efforts moved on to the next-best grade after that, subbituminous coal, which has been making up the difference to allow U.S. domestic production of coal to continue steadily growing. Most recently lignite has been getting into the game. Once subbituminous coal peaks, which someday it will, we will then most likely see lignite take off.

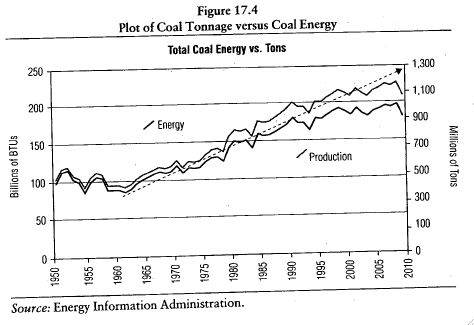

This all relates back to the point on EROEI. The graph above shows the total energy content of the coal mined, in addition to the total tons of coal mined. As seen, the amount of energy being created out of what is being mined is declining. This implies that the US is using more energy and spending more money to produce more tons of coal, but is essentially getting less energy back per ton for its troubles. This is all quite logical. The highest grades of the most-accessible coal were exploited first, leaving the less-energy-dense, less-useful, and less-accessible reserves for later. Welcome to “later.”

As the quality of coal is declining, the demand for coal is only increasing. In particular, non-OECD countries, including China, are expected to increase their consumption of coal by 36% from 2010 to 2025 (EIA). If the timeline changes to a range that begins in 2007 and ends in 2035, world use of coal is to grow by 56%! Most of this demand is coming from developing countries such as China and India. In 2007, China was building the equivalent of one new 1 gigawatt coal-fired plant every week. Now consider the fact that as of May 18th, 2011 China has begun to ration the use of electricity due to high costs.

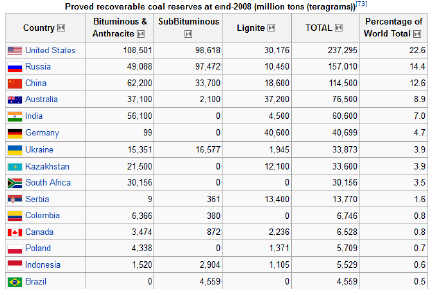

This increase in demand will cause serious pressure in the marketplace and should cause prices to continue moving upward as they have been since early last decade. This all bodes very well for the US considering that the US is considered to be the “Saudi Arabia of Coal.” As we can see in the following chart, the US has over 22% of the world’s coal reserves.

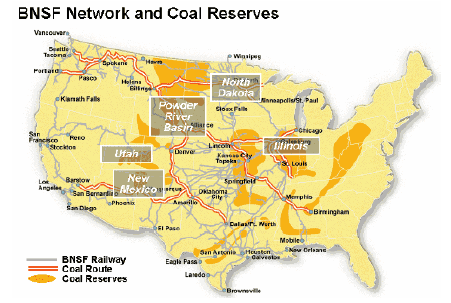

Coal has the potential to become a key export commodity for the US going forward. The US has been running massive trade deficits for decades, and therefore President Obama has made it public that he is determined to double US exports in 5 years. Warren Buffet has positioned himself nicely to play this trend with his $26 billion purchase of Burlington Northern Santa Fe (his largest purchase ever). Over 25% of BNSF’s revenue comes from shipping coal on its rails. BNSF’s rail network meets up with the west coasts port cities, and most importantly with Vancouver where North America’s largest coal export facility is located.

Whether the US actually begins to export more of its coal is up for debate. Considering how tight and shaky world energy markets are, there is a good chance that US coal stays home for domestic use. Either way, US coal should be going to the highest bidder, and those bids will likely be going quite a bit higher.

Metallurgical Coal:

Metallurgical coal (also called met coal or coking coal) is a high-grade coal that is used in making steel. Due to major supply and demand factors, met coal is fast becoming a prized strategic asset.

Met coal prices go for roughly three times the price of coal used to generate electricity. Steelmakers are willing to pay a lot of money to secure it. And producers of met coal are in high demand, judging from the mergers and acquisitions this year alone:

Rio Tinto offering $4 billion to buy out Riversdale Mining.

Arch Coal offering $3.4 billion for International Coal Group.

Alpha Natural Resources buy out of Massey Energy for $8.5 billion.

Chinese, Indian and Brazilian steelmakers have expanded capacity and built many new mills along their coastlines ready to import met coal. China doesn’t have enough and has been a net importer since 2009. India suffers from chronic shortages of met coal, and Brazil will also have to import a lot. Japan, which is already the world’s #1 importer, will be ramping up imports in order to re-build after the earthquake.

Currently, the big exporter is Australia. However, various bottlenecks have emerged there, including delays in port infrastructure projects and flooding issues. The second-largest exporter is the U.S. Though the U.S. has by far the most met coal reserves in the world, it will have a hard time increasing exports drastically due to infrastructure and logistical issues. Limited rail and port capacity is essentially capping U.S. exports at around 120 million tons (this represents the entire coal export market; met coal is just a small fraction of that).

Re-iterating the point, the above graph shows how limited met coal reserves are. Met coal would fall under the Low-Volatile Bituminous Coal category. This graph indicates what limited amount of Met coal there really is. Especially when you consider that these are the largest deposits in the world!

Over the past year, met coal prices have been pushing higher very aggressively. Again, basic supply and demand is causing the price moves.

BHP Billion, a $235 billion international resource company, has been pushing its customers to agree to monthly contracts, rather than quarterly contracts, due to the overall bullish trend in the met market.

It’s imperative to understand that nothing goes up in a straight line, metallurgical coal prices included. However, the bullish trend in met coal prices is very sustainable, and going forward met coal prices will be heading higher. Corrections will be shallow, and moves upward will be powerful.

* This article and data was compiled and submitted by Jared Rifenbary

To print a PDF copy of this report ---> CLICK HERE

Below you will find an article from an investing newsletter that one of our members forwarded to us. This is an excerpt of the article relating to our interests in met coal. Notice how the effects of disasters and economic changes throughout the world have created an ideal time to participate in met coal production and exporting. Although Austrailia is the largest exporter of met coal, any met coal mining operation is in an excellent long term profit position for the next decade or longer.

.........................................................................................................

March 18, 2011

High Energy: Long-Term Supply and

Demand for Oil and Metallurgical Coal

by Peter Staas

Although oil prices command the most headlines, coal prices have also run up considerably in 2011, bolstered by extensive flooding in Queensland, Australia that closed approximately 75 percent of the coal mines in the state and shut down key transportation infrastructure. Queensland accounts for much of the country’s metallurgical (met) coal production.

Australia sells roughly 80 percent of its black coal production to overseas markets, making it the world’s leading exporter of the commodity. The country accounts for more than half of the international trade in met coal, the variety used in the iron and steel industries. As you can see in “After the Flood,” the average weekly price of Australian hard coking coal has skyrocketed in the wake of the devastating floods.

Australia sells roughly 80 percent of its black coal production to overseas markets, making it the world’s leading exporter of the commodity. The country accounts for more than half of the international trade in met coal, the variety used in the iron and steel industries. As you can see in “After the Flood,” the average weekly price of Australian hard coking coal has skyrocketed in the wake of the devastating floods.

That customers have been willing to pay such exorbitant prices for met coal underscores the strength of global demand, particularly in China and India, which, together account for slightly less than one-third of Australia’s exports of coking coal.

In the near term, these elevated prices ensure that producers such as Peabody Energy Corp (NYSE: BTU) don’t suffer too much from decreased output. But the long-term growth story also remains attractive: Demand for Australian met coal will only increase as emerging Asian economies continue to develop.

In fact, according to Peabody Energy, global consumption of met coal will grow by 600 million metric tons over the next 10 years, with demand in China and India leading the way. As the coal super-cycle unfolds, the price of Australia’s high-quality met coal will continue to climb.

Investors should continue to add exposure to names that will benefit from tightening supply and demand in the global oil and coal markets. Not only will this strategy pay off over the long term, but as recent developments suggest, any temporary hits to supply can also lead to impressive short-term returns.

In the near term, these elevated prices ensure that producers such as Peabody Energy Corp (NYSE: BTU) don’t suffer too much from decreased output. But the long-term growth story also remains attractive: Demand for Australian met coal will only increase as emerging Asian economies continue to develop.

In fact, according to Peabody Energy, global consumption of met coal will grow by 600 million metric tons over the next 10 years, with demand in China and India leading the way. As the coal super-cycle unfolds, the price of Australia’s high-quality met coal will continue to climb.

Investors should continue to add exposure to names that will benefit from tightening supply and demand in the global oil and coal markets. Not only will this strategy pay off over the long term, but as recent developments suggest, any temporary hits to supply can also lead to impressive short-term returns.

March 14 (Bloomberg) -- Hong Kong’s Hang Seng Index rose, led by steel and coal producers, on speculation Japan’s strongest earthquake on record will boost demand for raw materials needed to rebuild from the devastation.

“The rebuilding process will drive demand for cement, timber, steel, copper, aluminum, coking coal and telecom equipment,” wrote analysts at UOB Kay Hian Holdings Ltd. in a research report today.

For the rest of the story click the link below:

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=ayVKt1qheaZY

“The rebuilding process will drive demand for cement, timber, steel, copper, aluminum, coking coal and telecom equipment,” wrote analysts at UOB Kay Hian Holdings Ltd. in a research report today.

For the rest of the story click the link below:

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=ayVKt1qheaZY

-------------------

Australia floods cut 5 % of world coking coal supply <-- CLICK ON LINK

This is good for the U.S. and the demand for our Met coal!

-------------------

“In 2010, the global coal-mining sector witnessed merger and acquisition transactions worth more than $47 billion through over 968 transactions, the highest number of deals on record. The increased corporate activity in the sector and the strong coal market fundamentals made American Power's board of directors search for an advisor that could help the Company take advantage of this market environment”? American Power Corp.

-------------------

Massey Energy shares rally on buyout deal

January 31, 2011

“Massey Energy Co. shares rallied Monday, surging after Alpha Natural Resources Inc. agreed to buy the metallurgical coal producer at a premium in a cash-and-stock deal valued at $8.5 billion

Alpha Natural said it will emerge with reserves of 5 billion tons -- one of the world's largest holdings of metallurgical coal, which is used for making steel.

Prices for metallurgical coal have risen this year after flooding of coal mines in Australia. Demand for steel is also on the rise as economic growth picks up steam in the developing world and elsewhere.

"Together we will be America's largest supplier of metallurgical coal for the world's steel industry and a highly diversified supplier of thermal coal to electric utilities in the U.S. and overseas," Alpha Natural CEO Kevin Crutchfield said.

The transaction is expected to close in mid-2011, subject to approval by each company's stockholders as well as regulatory clearances.”

-------------------

Rio Tinto Now Needs Riversdale Approval For Takeover

January 21, 2011

Rio Tinto PLC (RIO.LN) said Friday the Australian Treasurer approved its takeover bid for Riversdale Mining Ltd. (RIV.AU) and now the company must woo Riversdale's board to close the deal. ?The Australian approval was the main regulatory hurdle the miner needed to clear for its A$3.9 billion offer for Riversdale made toward the end of last year… Riversdale has 13 billion metric tons in coking and thermal coal resources, key materials in the steel production process, in its Benga and Zambezi projects in Mozambique

-------------------

Massey Energy shares rally on buyout deal

January 31, 2011

“Massey Energy Co. shares rallied Monday, surging after Alpha Natural Resources Inc. agreed to buy the metallurgical coal producer at a premium in a cash-and-stock deal valued at $8.5 billion

Alpha Natural said it will emerge with reserves of 5 billion tons -- one of the world's largest holdings of metallurgical coal, which is used for making steel.

Prices for metallurgical coal have risen this year after flooding of coal mines in Australia. Demand for steel is also on the rise as economic growth picks up steam in the developing world and elsewhere.

"Together we will be America's largest supplier of metallurgical coal for the world's steel industry and a highly diversified supplier of thermal coal to electric utilities in the U.S. and overseas," Alpha Natural CEO Kevin Crutchfield said.

The transaction is expected to close in mid-2011, subject to approval by each company's stockholders as well as regulatory clearances.”

-------------------

Rio Tinto Now Needs Riversdale Approval For Takeover

January 21, 2011

Rio Tinto PLC (RIO.LN) said Friday the Australian Treasurer approved its takeover bid for Riversdale Mining Ltd. (RIV.AU) and now the company must woo Riversdale's board to close the deal. ?The Australian approval was the main regulatory hurdle the miner needed to clear for its A$3.9 billion offer for Riversdale made toward the end of last year… Riversdale has 13 billion metric tons in coking and thermal coal resources, key materials in the steel production process, in its Benga and Zambezi projects in Mozambique

Note: In the article posted below, "The Unexpected Crisis in Coal" you will find out "WHY MET COAL IS HOT!" Read the whole article and you will begin to understand why everyone is so excited about participating in the metallurgical coal market for the next decade!

The Unexpected Crisis in Coal

Published: November 2010 (with references)

On Saturday night, May 8, 2010, a coal mine in western Siberia was rocked by a methane explosion. Officials of the Raspadskaya Coal Company, which operates the mine, confirmed 43 people dead, 7 in critical condition in the hospital, and 47 more still missing. As described by Business Insider (1) at the time, about four hours later, 19 rescue workers were making their way through the mine when a second blast killed them all and incapacitated the deep-tunnel ventilation system. Worse yet, the water level in the mine began to rise. By the following week, the Russian news agency RIA Novosti (2) was reporting 66 confirmed dead, 100 injured, and 24 people still missing. Shipments of coal from the mine were immediately cut by 70 percent and rescue attempts had been suspended in the face of high levels of methane gas. That single mine represented 10 percent of all the coal in Russia. Restoring the mine to its previous operating level was expected to take at least a year and cost $200 million. The explosion took 65 percent of Russian coal off the market for steel mills and export clients.

This took place, according to The Financial Express, (3) just as authorities in India were reporting a shortfall in coal mining output and predicting shortages at India's coal-fired power plants and subsequent summer blackouts. At one point during the summer of 2010, 17 power plants in India had only a seven-day supply of coal on hand, while 15 others could run for just four days on available supplies. The standard is to have enough coal in stock to run the plants for between two weeks and one month. The authorities had the money to buy additional coal, but found that supplies were not available on the export market.

As reported by Bloomberg News, (4) India and Russia are not alone in facing coal shortages. As the largest consumer of coal in the world, China has added so much capacity for generating electricity, producing steel, and processing metal in recent years that it couldn't get enough coal to meet the demands of the coldest winter in half a century in 2009. China's $586 billion stimulus package, intended to encourage spending, also increased the demand for energy. In the face of that demand, coal prices rapidly rose by 40 percent.

According to Business Line, (5) China has been a net importer of coal for more than two years — and imports to China more than doubled in 2009.

India gets 75 percent of its coal from Indonesia. Although India has domestic supplies of coal, it has infrastructure problems in moving it and its coal is of a lower quality that produces less heat, and therefore, commands a lower price. Indonesian coal, for example, produces twice as much heat per ton as Indian coal.

With the Chinese economy expected to grow four times faster than the U.S. economy in 2010, the demand for coal — which produces 80 percent of the electricity that is used in China — can only grow.

According to Stansberry Associates, (6) China represents a surprisingly big threat when it comes to the sustainable — and affordable — use of coal in the United States for producing electricity. Demand for electricity in China is growing by nine percent a year. It has tripled its electrical generation capacity in the last 10 years. Already, China burns three times as much coal as the United States, but it possesses just half the reserves. In fact, its reserves represent just 16 years of consumption at its present growth rate. China is building new coal-fired power plants at a rate of one a week, with no end in sight. Meanwhile, since 1990, the United States has built just twelve new plants.

China now gets most of its coal from Australia, consuming 60 percent of that nation's production. With China's electrical production expected to double again by 2018, it will then consume all of Australia's available coal output. Unless it shifts to nuclear, or some other dramatically different energy source, China's demand for coal will eventually equal the entire global production capacity.

India's demand is growing at the same rate. Today, about 70 percent of its electricity comes from coal, and a lot of that comes from its inferior domestic supplies. Even so, its imports of coal from South Africa increased 74 percent in 2009.

This enormous upward leap in global energy demand is primarily driven by the 600 million people, roughly equally divided between China and India, who are rapidly becoming "middle-class" consumers.

But, there are supply-side factors that make the coal picture even more daunting. As the Russian mining disaster reminds us, mining coal is a dangerous business. When disaster strikes — and sooner or later it always does because of the flammable nature of the materials involved — coal production stops.

Massey Energy is the largest coal mining company in the coal-rich Central Appalachian region of the United States and is a global exporter. According to The New York Times, (7) just a month before the Russian disaster, 25 miners died in a methane explosion at the company's Upper Big Branch mine. The mine and its parent company have a long and dismal safety record, which is the norm for coal mining operations. It has paid some of the largest penalties in history as a result. In the aftermath of that disaster, the mine closed and has not reopened. This puts yet more pressure on coal supplies and prices.

Exploding demand and constricted supply are leading to a dramatic price increases. As "the Saudi Arabia of coal," the United States will benefit to a large extent. The Peabody Energy Corporation, the largest producer of coal in the United States, is shipping coal to China, Korea, and Chile from the Powder River Basin in Wyoming, the largest and least expensive coal deposit on the continent. (8)

However, even the United States is not immune from the effects of this growing crisis. The two largest power companies in America — American Electric Power and Southern Company — are being run on ever-increasing levels of debt that could foreshadow bankruptcy. They can't stand a large increase in the price of coal. Southern Company, for instance, hasn't had any real income since 2006. The company lost $238 million that year. By 2009, it had lost $1.5 billion. It has only been able to keep up its cash dividends to shareholders by borrowing about $12 billion since 2006. The expense of servicing that debt alone is nearly a billion dollars a year. Factoring in capital expenses to keep aging operations running, the company has to earn five billion dollars just to stay afloat—and before any profit is made. The equations of its business — selling electricity at market rates — show that goal is an impossibility. And that's the situation without any further increase in the price of coal.

In the medium term, the price of coal can only go up. That's frightening when you consider that between early 2009 and mid-2010 coal prices sky-rocketed 300 percent, and stockpiles of coal at U.S. power plants have fallen by 20.5 percent in the last year.

What do we anticipate given this looming crisis? We offer the following forecasts for your consideration.

First, India will face a coal shortage of at least 15 percent over the next 18 to 24 months. It's already laboring under a 10 percent annual shortfall. While the rate at which the people of India use electricity is growing around 10 percent a year, the rate of growth in coal production languishes at between five and six percent. Coal India Limited, which accounts for more than 80 percent of all the coal mined in India, is hampered in expanding its production because of inadequate infrastructure, such as railroads and loading facilities, and is stalled in about 17 new projects because of environmental permissions for new mines that have not been forthcoming. In fact, India still has enough coal in the ground to satisfy its domestic demands, at least for a few years going forward. But owing to antiquated bureaucratic systems, companies there have not moved to build the infrastructure and open those mines that have already been allotted. India represents a major investment opportunity for a company or consortium that can come in and untangle that snafu.

Second, China will face a critical shortage of coal. During the hard winter of 2009 to 2010, the factories of the coal-rich province of Shanxi experienced rotating blackouts to keep residential customers supplied with heat. Although Shanxi is home to a third of all of China's coal, it, like India, does not have the infrastructure to ramp up production. In addition, according to China Daily, (9) it has a contractual obligation to supply other parts of the nation. As the largest producer of steel in the world, China also faces a severe shortage of coking coal, the type of coal used in steel production. As a result, according to Bloomberg, (10) China is poised to enter a fight with Japan and South Korea for that resource. Unfortunately for Korea and Japan, China has proven itself skilled at "cornering markets" and controlling resources. In the last year, China increased imports of coking coal by a factor of 12. It is now ramping up efforts to siphon off all of the available coal for sale from exporters. Look for the price for coking coal to rise between 23 and 38 percent as the economic recovery continues. Thermal coal for heating will rise, but not quite as sharply, going up about 14 percent in the next year.

Third, the Australian coal industry represents significant investment opportunities going forward. Australia controls the world supply of coking coal, which will experience a significant global shortfall within the next five years. At present, 62 percent of coking coal comes from Australia. Its coking coal is well-placed for shipment and well-explored, putting Australian companies in the leading position in this industry. Increasingly, that nation will dictate the terms, including amounts and prices. Expect profits to boom for those Australian firms in the coming years.

Fourth, steel prices will rise sharply. Since coking coal is essential to steel making, the increase is inevitable. That means that everything from cars to construction will cost more. According to the Guardian, (11) British manufacturers that make components for automobiles have already seen a 20 percent rise in the price of steel and expect it to continue. They will have to try to pass those costs on to customers. Many contractors for large construction projects have already agreed to supply their clients steel components at a pre-arranged price. Those agreements could see them facing steep losses while future projects may be put on the back burner.

Fifth, coal represents a good investment opportunity for the sophisticated — but let the buyer beware. Some companies that look attractive at first blush, such as Massey Energy, may already be overpriced, while others like, Arch Coal, that seem to be high, may have abundant growth ahead. A careful analysis of a company's stock price relative to real growth of operating cash flow will give a clearer picture of upside potential. Given this caution, however, a great deal of wealth is going to be made in the coming years from investing in coal and related businesses.

References

(1) Business Insider, May 11, 2010, "Methane Blast Post Mortem: coking Coal Shortage Looms as Raspadskaya Mine Toll Rises," by John Helmer. © Copyright 2010 by Business Insider, Inc. All rights reserved. http://www.businessinsider.com

(2) RIA Novosti, May 20, 2010, "Raspadskaya Coalmine Director Formally Charged." © Copyright 2010 by RIA Novosti. All rights reserved. http://en.rian.ru

(3) The Financial Express, July 10, 2010, "Acute Coal Shortage Fuels Blackout Fears," by Indronil Roychowdhury. © Copyright 2010 by The Indian Express Limited. All rights reserved. http://www.financialexpress.com

(4) Bloomberg.com, February 22, 2010, "Coal Rally on Chinese Demand Sparks $59 Estimates (Update2)," by Mario Parker. © Copyright 2010 by Bloomberg LP. All rights reserved. http://www.bloomberg.com

(5) Business Line, April 21, 2010, "Coal Prices Rise on China, India Demand," by Vishwanath Kulkami. © Copyright 2010 by The Hindu Business Line. All rights reserved. http://thehindubusinessline.com

(6) DailyWealth.com, August 12, 2010, "How to Hedge Yourself from the Coming Fed Disaster," by Porter Stansberry and Braden Copeland. © Copyright 2010 by Stansberry & Associates Investment Research. All rights reserved. http://www.dailywealth.com

(7) The New York Times, April 9, 2010, "No Survivors Found After West Virginia Mine Disaster," by Ian Urbina. © Copyright 2010 by The New York Times Company. All rights reserved. http://www.nytimes.com

(8) Bloomberg.com, June 24, 2010, "Peabody Energy Sees Global Coal Demand at the Beginning of a 'Super Cycle,'" by Mario Parker and Noah Buhayer. © Copyright 2010 by Bloomberg LP. All rights reserved. http://www.bloomberg.com

(9) China Daily, January 9, 2010, "China's Coal-Rich Province Rations Power Amid Icy Weather." © Copyright 2010 by China Daily Information Co. All rights reserved. http://chinadaily.com.cn

(10) Bloomberg.com, December 18, 2009, "China's coking Coal Shortage to Spur Demand Fight (Update1)," by Bloomberg News. © Copyright 2009 by Bloomberg LP. All rights reserved. http://bloomberg.com

(11) Guardian, April 1, 2010, "Industry Fears Steel Price Hike Will Derail Recovery," by Katie Allen. © Copyright 2010 by Guardian News and Media Limited. All rights reserved. http://www.guardian.co.uk

Caterpillar Capitalizes on Demand in Emerging Markets

Metallurgical Coal Update

Posted: Sep 21, 2010 12:01 PM by Eric Fox

Producers of metallurgical coal must be nervously watching the raging debate over the economy, as the fortunes of producers of this commodity are tied tightly to global economic growth, particularly in the developing world.

The Process

The demand for metallurgical coal is tied to the level of activity in the steel industry as this commodity is used in the process of making steel. Metallurgical, or coking, coal is first converted to coke through heating the coal in an oxygen free environment. After the coke is produced, it is added to iron ore in another high-temperature environment to produce iron. Every ton of steel made in a traditional blast furnace requires 0.6 tons of metallurgical coal, according to the World Coal Institute. Approximately 66% of all steel is manufactured using this method.

The demand for metallurgical coal is tied to the level of activity in the steel industry as this commodity is used in the process of making steel. Metallurgical, or coking, coal is first converted to coke through heating the coal in an oxygen free environment. After the coke is produced, it is added to iron ore in another high-temperature environment to produce iron. Every ton of steel made in a traditional blast furnace requires 0.6 tons of metallurgical coal, according to the World Coal Institute. Approximately 66% of all steel is manufactured using this method.

Steel Statistics

The global production of steel in July, 2010 totaled 115 million metric tons, a 9.6% increase on a year-over-year basis. Capacity utilization was 75.1% in July, 2010, up on a year-over-year basis, but a sequential decrease from capacity utilization of 80.4% in June, 2010.

Demand

World seaborne or export demand for metallurgical coal is expected to increase 20% in 2010 over 2009, with strong demand coming from Asia and South America. The largest importers of metallurgical coal in 2010 include China (44 million tons), India (30 million tons) and Brazil (14 million tons). Japan, Korea and Taiwan will require another 94 million tons in 2010.

World seaborne or export demand for metallurgical coal is expected to increase 20% in 2010 over 2009, with strong demand coming from Asia and South America. The largest importers of metallurgical coal in 2010 include China (44 million tons), India (30 million tons) and Brazil (14 million tons). Japan, Korea and Taiwan will require another 94 million tons in 2010.

Supply

World seaborne supply of metallurgical coal is expected to increase by 13% in 2010 over 2009, with supply growth coming from the United States and Australia. Many companies have been adding capacity. Massey Energy (NYSE: MEE) recently announced that the company was developing a new mine to produce metallurgical coal in West Virginia. The company will spend between $100 million and $160 million through 2012 at the Rowland reserve.

World seaborne supply of metallurgical coal is expected to increase by 13% in 2010 over 2009, with supply growth coming from the United States and Australia. Many companies have been adding capacity. Massey Energy (NYSE: MEE) recently announced that the company was developing a new mine to produce metallurgical coal in West Virginia. The company will spend between $100 million and $160 million through 2012 at the Rowland reserve.

Prices

The recent benchmark price for metallurgical coal was $209 per metric ton, with analyst forecasts of prices for 2011 between $190-275 per metric ton. The mean price forecast for 2011 is $221 per metric ton.

The recent benchmark price for metallurgical coal was $209 per metric ton, with analyst forecasts of prices for 2011 between $190-275 per metric ton. The mean price forecast for 2011 is $221 per metric ton.

Companies

Massey Energy updated its guidance for 2011 and 2012, and made favorable comments on the outlook for metallurgical coal prices during that time frame. "Our early negotiations with metallurgical coal customers give us reason to expect pricing in 2011 will be favorable to what we have realized in 2010," said Don Blankenship, the CEO of Massey Energy.

Cliffs Natural Resources (NYSE:CLF) is one of the most leveraged domestic producers of metallurgical coal. The company expects to sell a total of 3.9 million tons of coal in 2010, of which 3.4 million will be metallurgical coal.

To see the complete story with links, click ------> HERE

An Overview Of Future Demand And Prices Of Coking Coal by: Vaiv Jais

Coking coal or coke is the fuel produced from coal by the process of coking. It is one of the most preferred fuels used for smelting in a blast furnace. Steel production is one big industry that makes use of coke as a fuel. This has led to a global increase in the demand of coke produced from coal.

As a result, there has been a steep rise in the demand as well as price of coke in the past couple of years. Considering the demand of coking coal buyers, one can expect the trend to continue for the years to come. Here is a discussion about the present trends and future expectations of coking coal prices and demand.

One country that has significantly contributed in the rise of coke price is China. The country’s total steel production is over 600 metric tones per year at present. This certainly has added to the demand of coking coal to keep the steel production up and going. In the year 2009, China imported more than 30 metric tones of coke. This steep rise in the demand has enforced the coke prices to shoot up. It is amazing to see the coke prices to rise from $129 to $200 per ton within the difference of a year.

After China, the second country that has experienced an increase in the demand of coking coal is India. Though, the country’s steel production of 60 metric tones per year is nowhere near to that of China. The country’s steel production growth rate is higher than that of China and this has raised the expectation that total steel production in the country will double by 2012. And the experts in the industry firmly believe it to cross 200 metric tones a few years later. This will certainly led to increase in the demands of coking coal buyers from the country.

As far as the European countries and those in the American continents are concerned, they are too expected to raise their demand for coke. Coke is used as the most preferred smelting agent for the blast furnaces in these countries. The period of recession definitely had an adverse effect on the import of coke by these countries. As the period of recession is getting over, these countries should again start importing more of the coking coal.

Another important development in the industry is that the annual contracts have been shifted to quarterly contracts. BHP of Australia, the largest mining firm in the world, has recently entered into first such contract with JFE Steel of Japan. According to the contract, the coking coal prices are set at $200 per ton. The trend of quarterly contracts is further going to push the coking coal prices upwards. So, those indulged in coal mining and coke production are expected to make great profits in the near future.

You can expect the prices per ton of coking coal to touch the mark of $300. Besides, the rise in the demand of coke would keep on putting pressure on the global supply and demand lines.

As a result, there has been a steep rise in the demand as well as price of coke in the past couple of years. Considering the demand of coking coal buyers, one can expect the trend to continue for the years to come. Here is a discussion about the present trends and future expectations of coking coal prices and demand.

One country that has significantly contributed in the rise of coke price is China. The country’s total steel production is over 600 metric tones per year at present. This certainly has added to the demand of coking coal to keep the steel production up and going. In the year 2009, China imported more than 30 metric tones of coke. This steep rise in the demand has enforced the coke prices to shoot up. It is amazing to see the coke prices to rise from $129 to $200 per ton within the difference of a year.

After China, the second country that has experienced an increase in the demand of coking coal is India. Though, the country’s steel production of 60 metric tones per year is nowhere near to that of China. The country’s steel production growth rate is higher than that of China and this has raised the expectation that total steel production in the country will double by 2012. And the experts in the industry firmly believe it to cross 200 metric tones a few years later. This will certainly led to increase in the demands of coking coal buyers from the country.

As far as the European countries and those in the American continents are concerned, they are too expected to raise their demand for coke. Coke is used as the most preferred smelting agent for the blast furnaces in these countries. The period of recession definitely had an adverse effect on the import of coke by these countries. As the period of recession is getting over, these countries should again start importing more of the coking coal.

Another important development in the industry is that the annual contracts have been shifted to quarterly contracts. BHP of Australia, the largest mining firm in the world, has recently entered into first such contract with JFE Steel of Japan. According to the contract, the coking coal prices are set at $200 per ton. The trend of quarterly contracts is further going to push the coking coal prices upwards. So, those indulged in coal mining and coke production are expected to make great profits in the near future.

You can expect the prices per ton of coking coal to touch the mark of $300. Besides, the rise in the demand of coke would keep on putting pressure on the global supply and demand lines.

Coking coal accounts for about 70% of the world's steel production. The coal is carbonized in the Blast furnace to produce Coke. The important specifications that require to be kept in mind include Ash, Volatile Matter, Sulphur and Phosphorus content of the Coal, Swelling Indices, dilatation, fluidity and reflectance in assessing its suitability for steel production. In the year 2000, the sea-borne metallurgical coal trade figures stood at approximately 180 million tons, with Australian coal account for the largest share at nearly 100 million tons.

Steel Production

This coal is used as a Source of Carbon, for converting a metal ore to the metal itself. This "Smelting" process, involves removing the Oxygen in the Ore by combining it with the Carbon in the Coal to form CO2. This involves burning the coal, which supplies the necessary heat to reduce the ore, and also to melt the resultant metal, helping to separate it from any slag produced in the process. Many thermal coals can also be used for metallurgical purposes.

PCI - Pulverized Coal Injection

The technology, known as PCI (Pulverized Coal Injection) for Steel Production has gained increasing acceptance since 1964. PCI coal is injected into the Blast Furnace, reducing the requirement for expensive Hard Coking Coals. Here low ash and Low Phosphorus content coals are being used. Low volatile coal is predominately sold to steel mills for use in the production of Pig Iron from iron ore in the blast furnace process. Steel mills may also use a small amount in the coke blend.

Individual plants have their own specification limits but usually all types of coal can be injected into the blast furnace. Low ash, low sulphur, low moisture and low phosphorus, though not mandatory, are desirable characteristic in the coal.

According to the U.S. Energy Information Administration: world coal consumption is projected to increase from 132 quadrillion Btu in 2007 to 206 quadrillion Btu in 2035... a stunning 56% increase. U.S. coal consumption is projected to climb from 1.07 billion short tons in 2009 to 1.90 billion short tons in 2030. That's a dramatic 77% increase.

Click On The Link Above

----> Then click the 6th box down that says:

"Average Cost of Metallurgical Coal Priced at Coke Plants"

You will see this years graph of prices which is updated from time to time.