Steps to Buy a Home

8 Easy Steps to Home Ownership

Closing

Step 8: Making it to Closing

You have got your credit in order, picked and provided your lender all your documentation, determined your needs vs. wants, selected the best realtor, found the right house, got an accepted offer, preformed all the inspections, and you are ready to close. You made it!

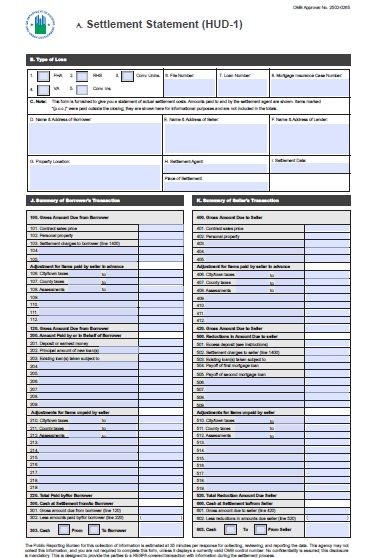

Closing a house requires pages and pages of paperwork. One of the most important forms will be your HUD1 – Settlement Statement. This form will show your purchase price, all costs, and any credits you will be receiving. It is very important to receive this form prior to your closing so you have a chance to review it and have any errors corrected.

You will also want to be sure the forms with your interest rate and loan terms are correct. Don’t sign anything if you have questions about the form or the information on it.

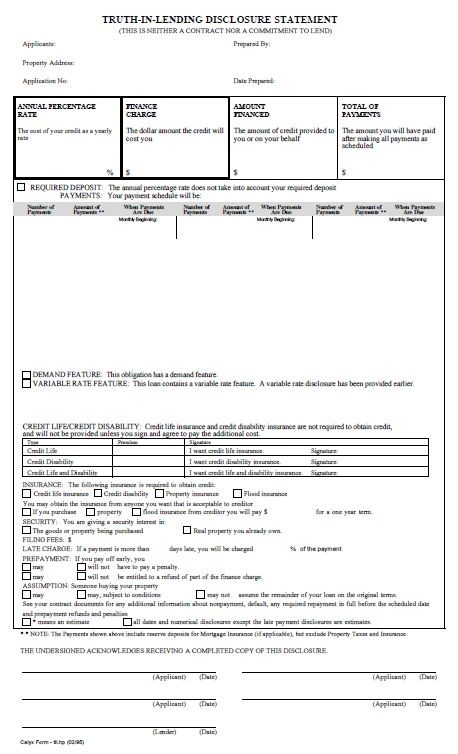

A form that is typically confusing to buyers is the Truth in Lending form. It shows your interest rate with the upfront costs figured in, your finance charge, the amount financed, and the total of all your payments over the length of your loan. The last figure is typically a heart stopper!